Charges claim federal officials withheld FinCEN guidance

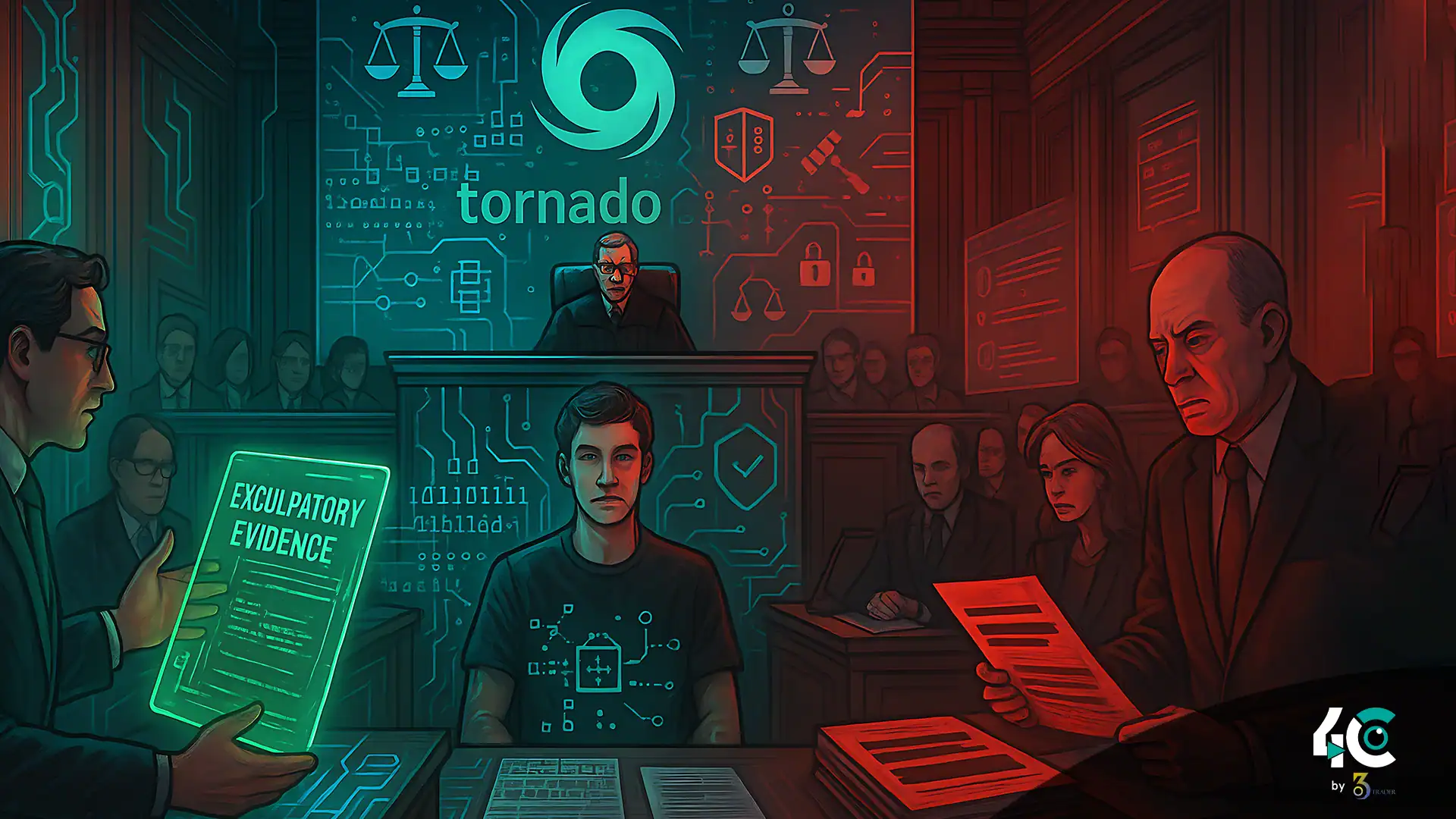

Lawyers for Roman Storm, a co-founder of Tornado Cash, allege that federal prosecutors purposely withheld evidence that could show Storm did not violate money-transmission laws.

A court filing dated May 16 states that Storm’s attorneys are relying on 2023 statements from the Financial Crimes Enforcement Network (FinCEN) that non-custodial crypto mixers (like Tornado Cash) are not money transmitting businesses under federal law. Even with this guidance, the prosecutors brought the criminal charges, which Storm’s lawyers say misdirected the court and denied his client a fair opportunity to defend himself.

Allegations arise from Samourai Wallet case

The latest allegations stem from the new Samourai Wallet developers case, which has been revealed in a separate case. According to reports, FinCEN officials suggested that both platforms likely fall outside the ambit of money service businesses (MSBs), as their platforms do not take custody of user funds. That classification is essential to the government’s claim regarding the unlicensed money-transmitting service.

Defense cites Brady violations

The attorneys for Storm argue that this FinCEN opinion was not disclosed properly at all, which violates Brady rules that require prosecutors to turn over evidence that may be helpful to the defense. Storm’s attorneys asserted that the administration misrepresented the facts. At the very least, they purposely deceived the court. They also argue that the similarities between Tornado Cash and Samourai Wallet are not only skin-deep, as the government claims, but rather at the very heart of the legal questions, that being their noncustodial nature.

Remaining charges and broader crypto implications

A charge of operating an unlicensed money-transmitting business has recently been dropped, but the case still includes conspiracy to launder money and to evade U.S. sanctions. Storm’s team is currently advocating for a thorough examination of all correspondence related to FinCEN, encompassing the intricate details of the Samourai case. Our goal is basically to determine whether the prosecution knew they were intentionally ignoring guidance that supported the innocence of their client.

The results of this case could significantly influence the structure of U.S. enforcement of crypto regulation, particularly as it relates to decentralized or non-custodial technology. Judge Katherine Failla in the Southern District of New York has not ruled on the matter yet.