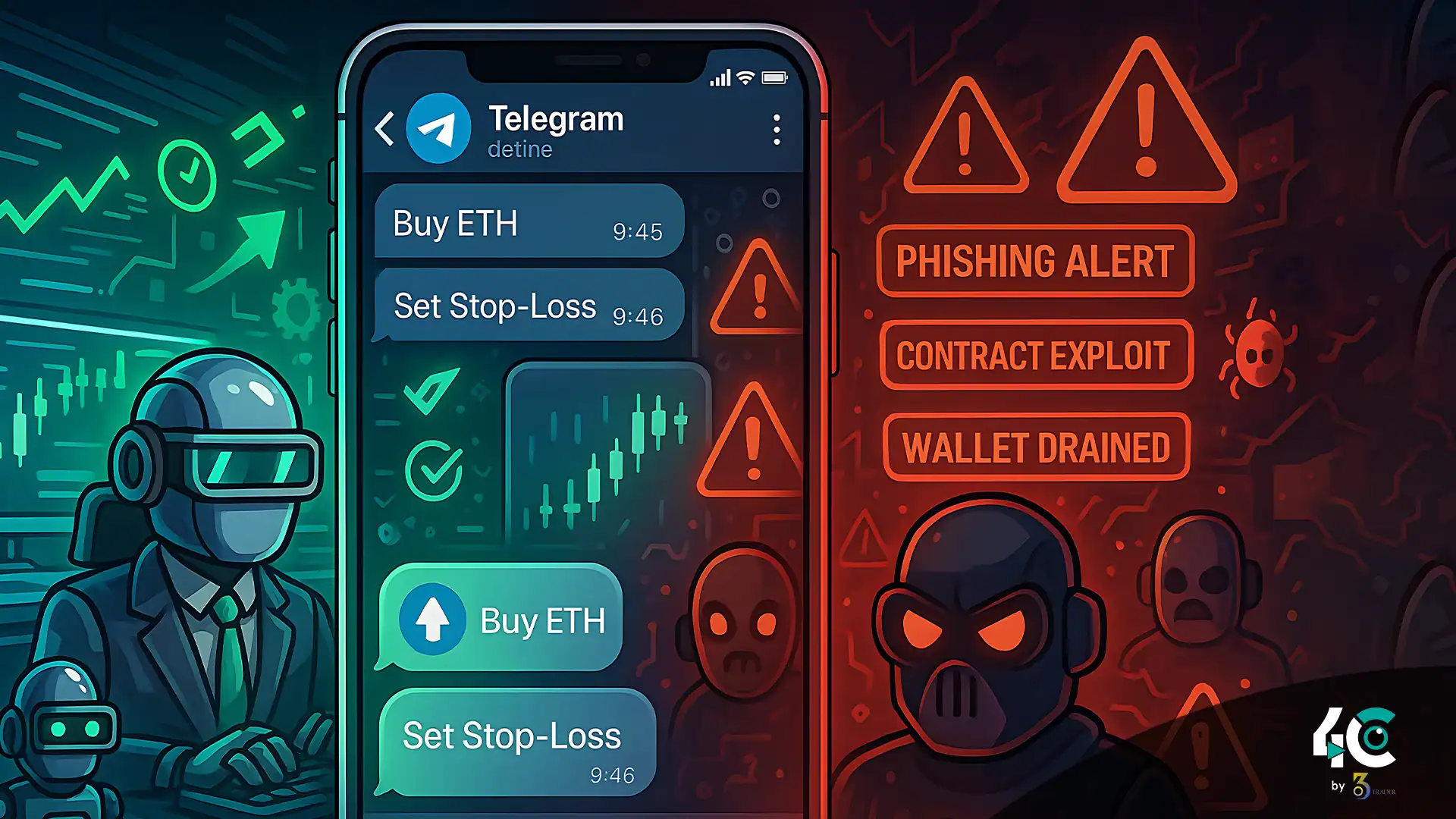

In the nonstop world of crypto, speed is everything, and it’s taking things to the next level with Telegram bots. Bots like Banana Gun, Maestro, Unibot, and others claim one-tap token snipes, automated trading strategies, and real-time execution through your friendly Telegram interface. But is the hype justified?

Let’s take a closer look at how these bots work, what makes them popular, and the risks traders need to know.

What Are Telegram Trading Bots?

A Telegram bot is a mini-software that connects via a crypto wallet (usually via private key or API) to give users the ability to place trades without the use of a DEX interface.

They typically offer:

- Customizable gas fees and slippage settings to buy or sell

- Sniping tools for presales or new token launches

- Copy trading from wallet addresses

- Auto-selling based on preset targets or stop-losses

For instance, Banana Gun got popular for its fast snipe on new tokens that are not yet listed. Along with trading, Maestro offers more complex portfolio management and analytics.

Speed vs. Slippage vs. Safety

These programs can provide an edge in speed—users claim to capture tokens mere seconds after a smart contract is deployed. But this speed can come at a cost:

- High slippage: You often need to allow for 50% slippage in exchange for faster execution.

- Gas wars: Bots competing on gas drive prices up, especially during hyped launches.

- Smart contract risk: Bots might interact with malicious or unaudited contracts.

- Wallet exposure: It’s always risky to hand over your private key or connect to unknown platforms.

Security varies widely between bots. Some platforms follow audit compliance and transparency (like Banana Gun), while others are closed-source or questionable. Always do your homework.

Real Trading Edge—or Just Hype?

The usefulness of these bots mostly depends on the user’s objective.

Telegram bots provide the fastest service for airdrop hunters, presale snipers, or memecoin chasers.

For due diligence (DD) investors, bots could also power portfolio tools, auto-rebalance, or enable quick exits.

For typical traders, however, they may be more trouble than they’re worth—or worse, an attack vector.

The line between edge and gamble is thin. During memecoin peaks, some traders have transformed limited accounts into huge fortunes. Many others lost everything by trusting unverified bots or buggy tokens.

Use Cases

Sniping New Tokens

Bots on Telegram help scan the mempool to detect token creation on Ethereum, BSC, Base, and others. These snipers can get in before the hype, although this is often a zero-sum game.

Copy Trading

Certain bots replicate trades of wallets marked as “smart money”, following trending patterns or winning strategies.

Auto-Buy/Sell Logic

Bots can be programmed to make purchases at predetermined price points. They can also auto-sell at a doubling point, 5X, or based on time or volume triggers.

Conclusion

Telegram trading bots can be a powerful tool in retail crypto trading. However, while they offer greater speed and automation, they also come with increased risks—such as contract vulnerabilities, wallet exposure, and unpredictable slippage.

If you plan to use one, go slow. Always use small amounts, audit everything, and never expose your main wallet. In skilled hands, these bots may be the future of edge-driven trading. But in the wrong hands, they are just another trap disguised as innovation.