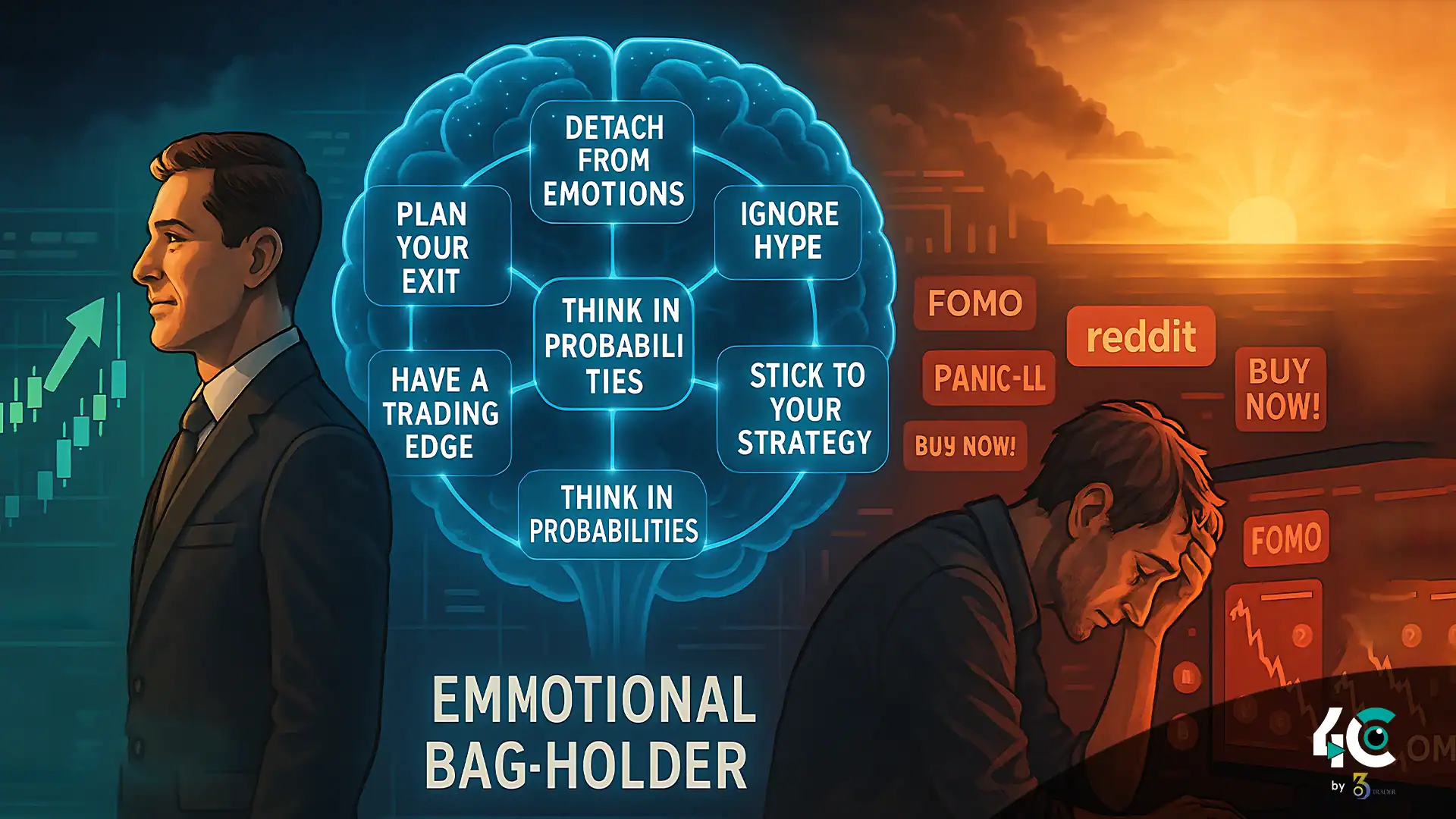

In crypto, technical analysis and market knowledge matter—but they’re not enough. The best traders use tools effectively. However, they are also masters of their mindset.

Trading setups, no matter how good, are rendered ineffective without emotional discipline. As far as traders are concerned, someone whose mind is clear will generally outclass another. And the ‘another’ here may use more complex trading strategies. Discover the key mindset differences that help traders make a profit instead of holding the bag like amateurs.

1. Process Over Outcome

Successful traders concentrate on establishing a system they can replicate. All trades must be part of a larger trading system, whether you are a breakout, range, or trend player.

Winners don’t celebrate lucky gains. When traders execute a trade, they review their logic, log the trade, and refine it when patterns don’t match. People who hold on to bags obsess over outcomes while chasing that memory wave of dopamine release.

2. Emotional Discipline

Volatility is part of the game. Your portfolio is most at risk due to fear, greed, and FOMO (fear of missing out).

Traders shouldn’t size up or down based on emotion. If you have rules, follow them. When prices pump, they wait for confirmation. When it dumps, they follow their plan—not the panic on X (Twitter).

3. Stop-Loss Discipline

Many traders in a losing position still hang onto bad trades hoping for a reversal. Profitable traders accept small losses as part of the game. A strict stop-loss strategy is non-negotiable.

Bag holders let losses bleed. Winners cut quickly and preserve capital for better setups.

4. Avoid Overtrading

More trades ≠ more profits. Overtrading is a major reason many fail. Emotional traders chase every move and burn out fast.

Don’t take trades when the setup isn’t right! They are not driven by impatience. Instead, they wait for high-probability setups and focus on clean execution.

5. Journaling and Reflection

Using a trade journal—even a simple spreadsheet—will help. It reveals your habits, strengths, and recurring mistakes.

Successful traders make it a habit to reflect on what’s working, where they slipped, and how they can improve. This self-awareness builds long-term profitability.

6. Resistance to Hype and Herd Mentality

Profitable traders don’t follow trends blindly because Crypto Twitter is hot. They analyze objectively, often counter-trading the crowd.

They also know when to step back during hype—or take profits while others are buying the top. Emotional resilience is their edge.

7. Daily Habits That Build Mental Strength

Mindset is built through small, consistent habits.

- Review market news with a calm, unbiased lens.

- Meditate or do breathing exercises before trading.

- Start the day with a clear trading plan.

- Reflect on wins/losses daily—without judgment.

Just 15–20 minutes of intentional preparation can enhance your entire trading mindset.

Conclusion

Winning trades don’t just happen—they are orchestrated. Your actions define real success; profit and loss follow later. The market rewards those who are patient, emotionally sound, and execute for the long term.

Bag holders blame the market. Profitable traders learn from every trade, take responsibility for their mistakes, and evolve as traders. If you want to thrive, start with your mind.