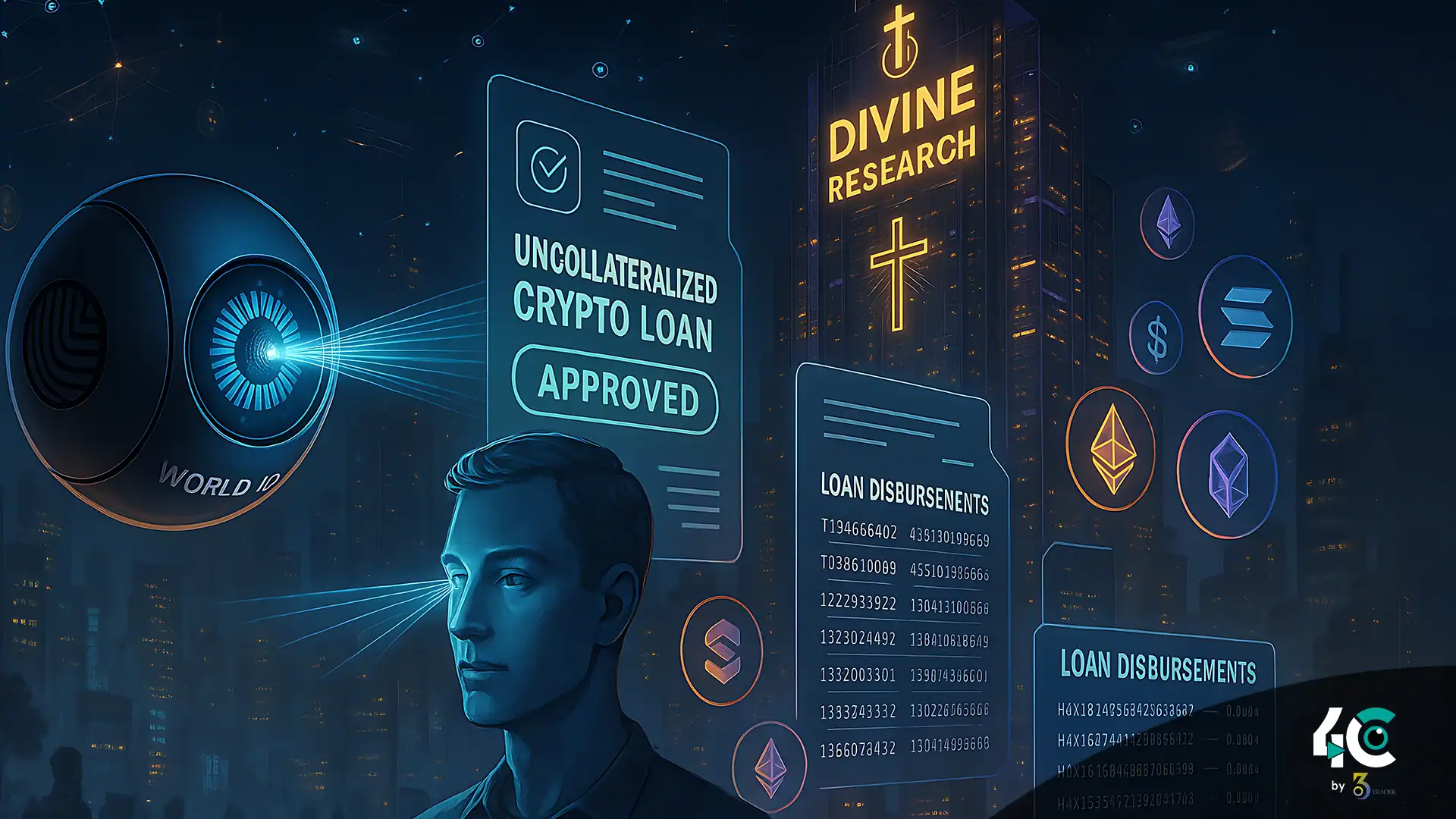

A San Francisco-based Divine Research firm is revolutionizing crypto-lending by providing uncollateralized short-term loans via biometric verification. The company has given about 30,000 loans in USDC since December, generally under $1,000 and mostly to unbanked borrowers in the Global South.

To prevent fraud and abuse, Divine uses World ID, a tool that relies on iris scans for digital identity, created by OpenAI CEO Sam Altman. This biometric tool ascertains that no two borrowers are the same, restricting them from reapplying under different names after defaulting.

Diego Estevez, founder of Divine Research, stated, “We are giving money to everyday people—schools, vendors, anybody who can go online.” “This is microfinance on steroids.”

The interest rates reflect the risk of not having collateral and range from 20% to 30%. The company has a loan default rate that will come pretty close to the 40% mark initially. The company also relies on the returns from these loan defaults as well as their World tokens that they offer to the borrowers, which are partially reclaimable.

Divine is different because it’s open to people. What this means is that the lending pool will be funded by people, not by institutions. According to Estevez, the system’s design will allow lenders to still profit even after a dose of losing.

Divine is part of a wider group of high-risk crypto lenders capitalizing on newly rekindled interest in digital finance. The rival firm 3Jane is also making unsecured credit available, while Wildcat is a lender to trading firms on customized terms. According to reports, even legacy bank JPMorgan is considering the push for crypto-backed loans.

Conclusion

Divine Research has smartly combined biometric identification and decentralized lending, transforming access to credit for the unbanked. Forget what you know! A new platform mixes high-risk finance with leading-edge technology to deliver unique offerings for borrowers and everyday investors. As institutional interest gains momentum and an increasing number of participants enter the lending space, World ID-verified lending could be next in line for evolution in crypto.