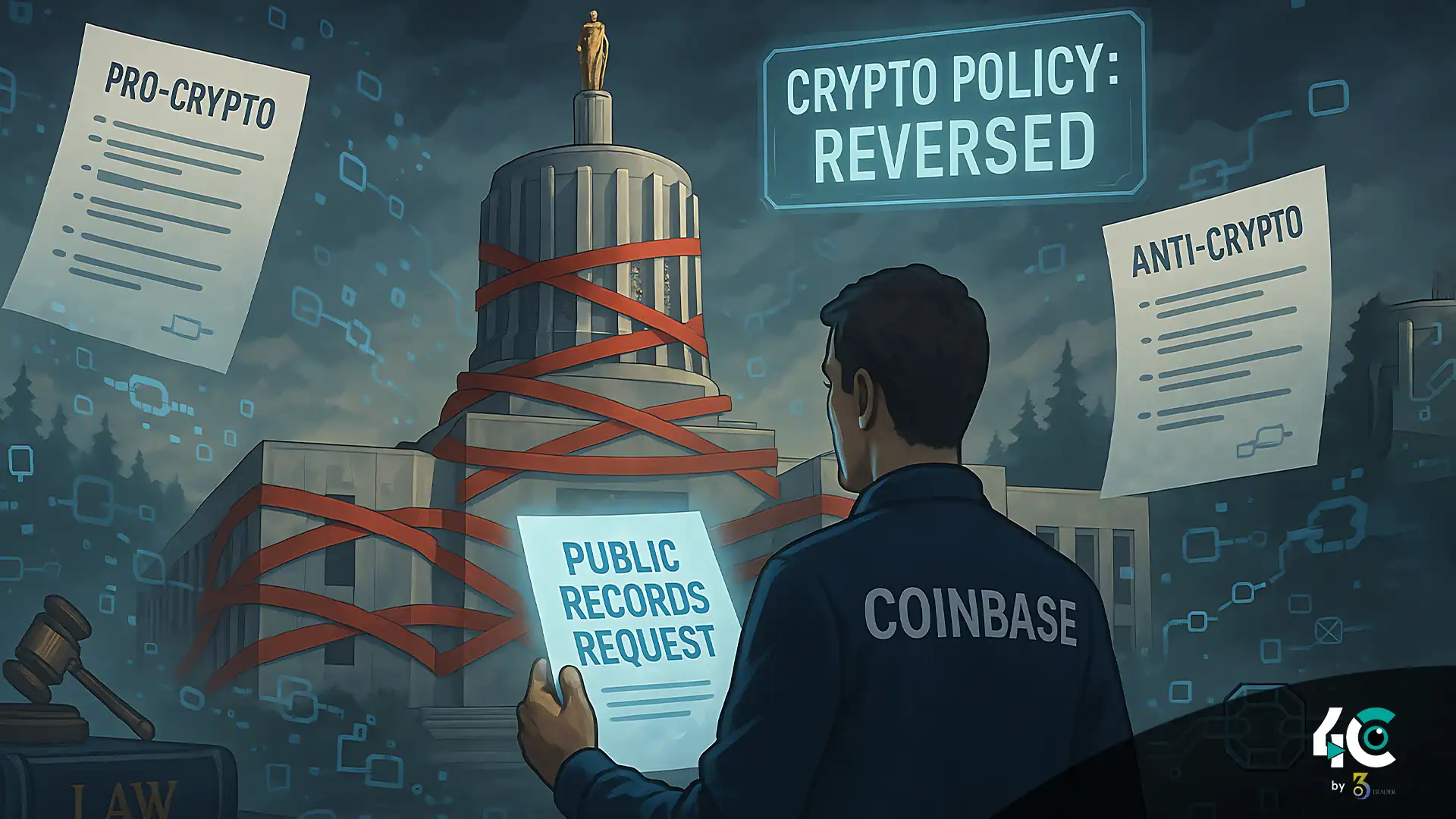

Coinbase is suing the state of Oregon. They must have undertaken a lot of research on the issue, though. Furthermore, they claim that the officials made a secret reversal regarding legalizing digital assets. Moreover, they say that the officials of the state are refusing to disclose public records about the reversal. The crypto exchange has taken legal action against the governor and the attorney general, filing for injunctive relief in 易 from the Marion County Circuit Court.

Oregon officials didn’t classify digital assets as securities in the past: Coinbase. That changed in April 2025. At that point, the state’s attorney general decided to sue Coinbase for allegedly offering more than 30 unregistered securities.

Paul Grewal, Coinbase’s chief legal officer, took to social media to vent. He said, “Oregon’s leaders silently shifted their stance on crypto, dodging hearings, rulemaking, and public comment.” Oregon officials are concealing the public records that justify their actions. “We are taking them to court to ensure transparency.”

The lawsuit claims Oregon officials broke state public records laws after Coinbase filed extensive requests—reportedly involving more than 80,000 emails. Coinbase argues that the documents they have sought are crucial to understanding the sudden change in state policy. They argue that the state is intentionally delaying their release.

It’s unclear if this lawsuit will change Oregon’s mind on crypto regulation. Nonetheless, the matter illustrates how crypto firms are facing more and more pressure from state and federal regulators.

Part of a Broader Fight for Crypto Regulation Clarity

Coinbase has a long history of asking regulators for openness. The exchange made several FOIA requests with the SEC, FDIC, and other federal agencies. These efforts try to find out whether the banks are instructed by the government to limit services to crypto-related businesses.

Washington legislators are also being pressured by Stand With Crypto, Coinbase’s political advocacy arm. The cohort is backing a number of proposed legislation that could fundamentally shape the regulatory framework of digital assets—a suite of legislation addressing stablecoins, market structure, and central bank digital currencies (CBDCs).

Conclusion

The lawsuit that Coinbase filed against the state of Oregon is part of the exchange’s larger mission: the lawsuit asks for fairness and transparency in the US. With federal legislation on the horizon and state policies changing, Coinbase is endeavoring to ensure digital asset companies are not left behind.