Bitcoin’s price fell to a three-week low of $91,530 on February 3 but recovered to $95,306 later that day. The fall coincided with increased investor concern over new trade duties imposed by the United States on China, Canada, and Mexico. According to market commentators, these economic measures fueled Bitcoin’s short-term decline.

Recent trends imply that Bitcoin is becoming increasingly sensitive to macroeconomic factors. The cryptocurrency, once seen as a hedge against financial instability, is now reacting sharply to policy changes and global economic disturbances. Analysts believe that investor attitude is changing as geopolitical risks influence market dynamics.

The new tariff pronouncements have spurred Canada, Mexico, and China to threaten retaliation, fueling worries of a protracted trade war. This uncertainty has prompted many investors to steer clear of riskier assets, including cryptocurrencies, leading to Bitcoin’s recent decline.

Market expectations are consistent with previous analyses, which predicted a short peak above $110,000 in January before a further decline. Some analysts predict Bitcoin will go below $70,000 in the foreseeable future, owing to swings in global liquidity and investor mood.

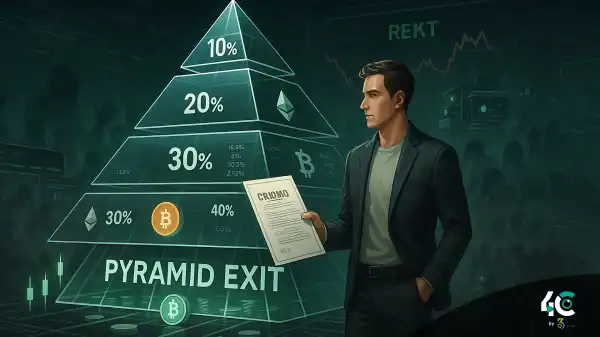

Despite the present crisis, some industry insiders are optimistic. While Bitcoin’s price fall reflects current macroeconomic concerns, its long-term significance as a hedge against inflation and currency depreciation remains unchanged. Analysts believe that if digital assets acquire traction, Bitcoin’s resiliency may fuel a substantial rebound in the coming months.

Looking beyond short-term volatility, Bitcoin’s potential for large gains remains strong. Despite current market uncertainty, we expect Bitcoin’s value to range between $160,000 and $180,000 in the remainder of 2025, confirming its long-term growth trajectory.